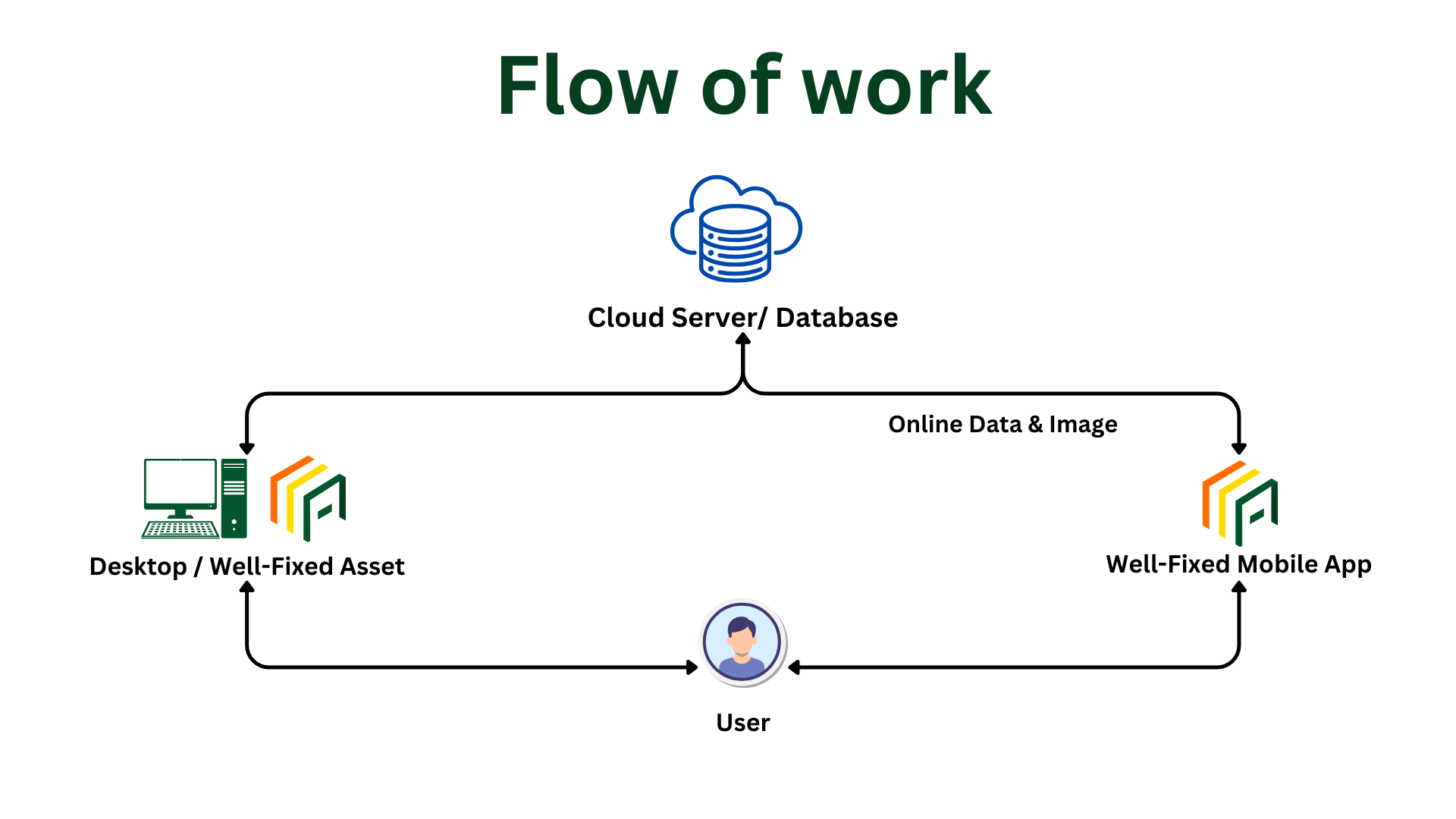

Well-Fixed Asset Software On-Hybrid

Database Location

Client

Cloud Server

Cloud Server

Program Location

Client

Client

Cloud Server

Internet Dependency

No

Yes

Yes

Scalability

Limited

Moderate

High

Well-Fixed Asset Software for Accounting

Well-Fixed Asset’s Accounting component handles account management and asset depreciation calculations. It can break down your company’s assets into Groups, Classes, Locations, and Cost Centers, as well as calculate depreciation summarized by Cost Center, with percentages allocated, linking them to your finance statement. In order to analyze profit and loss by Cost Center more efficiently and accurately, our software tracks asset management data in-depth, providing for daily, monthly, and annual asset depreciation calculations.

Well-Fixed Asset Software for Physical Count

Well-Fixed Asset’s Physical Count component uses barcode asset checking technology, available using a mobile scanner as well as a smartphone application. This makes the software easy for your employees to use, making asset-counting rapid, accurate, and efficient. It also guarantees that each and every asset and its value are correctly recorded in the system, while also tracking precisely how much capital you’ve invested.

Well-Fixed Asset Software Enterprise

Well-Fixed Asset Enterprise has two components: Physical Count and Accounting. As a complete asset management solution to help manage depreciation price of the asset, and also effectively control and manage the asset with barcode system.